Oprah Winfrey has talked about it.

The local news networks frequently report on it.

Still, many people are suspicious about the authenticity of unclaimed funds. So much so that they are hesitant to claim lost money and unclaimed funds that are rightfully owed to them.

Here’s what you need to know about unclaimed funds, plus how to find unclaimed money that’s owed to you, and how to claim your free money!

Find Out If You’re Owed Some Money

There once was a time when perhaps you should have been suspicious of anyone offering to help them find unclaimed funds. There used to be many websites and individuals who would try to charge you a fee to collect what is already yours.

However, thanks to intervention from the government, this information is now easy to find on your own.

Here are 3 legit ways to find unclaimed money that’s yours:

- Check the U.S. government unclaimed money website.

- All states in the U.S. maintain their own lists of unclaimed property and funds. Visit the National Association of Unclaimed Property Administrators (NAUPA) website to find each state’s unclaimed funds website.

- MissingMoney.com is also endorsed by NAUPA. This one lets you search for your name and all of the states in which you’ve resided to find free money.

How To Claim Your Free Money

To receive unclaimed or lost money, you simply need identification that proves the unclaimed money belongs to you. That means you will need things like:

- A valid photo ID

- A social security number

- Proof of name changes (if you were married or otherwise changed your name)

- Proof of death (if the money belonged to a deceased relative and you have rights to it)

Each of the 3 sites mentioned above provides you with the exact address and contact information to claim your lost funds.

Each state has its own process, which usually takes 3 to 4 months and requires information like your social security number and more. If you choose to use a locator business to claim your money in order to avoid doing the paperwork yourself, don’t pay up front. Also, don’t pay the company more than 10 percent or 20 percent of the amount of money you are claiming. Source

Why Is There So Much Lost Money?

Well, there are actually lots of reasons…

Scenario #1: Do you remember starting a savings account when you were a young child?

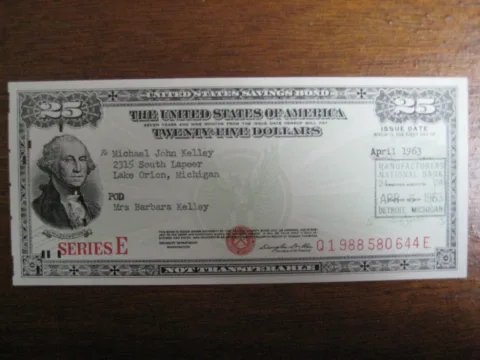

Perhaps you weren’t even aware that a bank account or a savings bond was issued in your name — it’s just something that your parents did for you. Then you moved and/or your parents passed away.

Over time, that bank account may have been forgotten.

The result: unclaimed money!

Scenario #2: Have you ever expected a tax return check that never came or a court settlement that never came through?

Or maybe you paid off a home loan and wondered if you were entitled to an FHA insurance refund?

Things get lost in the mail. As a result, the lost checks are never cashed.

The result: unclaimed money!

That’s just a sampler of the types of things that could result in unclaimed money.

In fact, there are dozens of scenarios of money being owed to you that you should look into.

Here are some more places you could have free money waiting for you:

- Forgotten savings and checking accounts

- Class Action lawsuits and “Investors Claims Funds”

- Uncashed checks

- Securities

- Dividends

- Bank failures

- Government benefits

- Insurance refunds or claims

- States’ unclaimed property

- Wages

- Pension Funds from former employers

- Utility refunds/deposits

- Bail bonds

- Child support payments

- Credit Union unclaimed shares

- Damaged money

- Tax refunds

- Heir to an inheritance you didn’t even know about

The odds are greater than you realize that there is lost money or unclaimed funds out there with your name on it!

More Tips For Finding Free Money

In addition to the links I’ve included above, here are some other resources to help you find free money that is owed to you: