You put your money in a bank. You put your food in a refrigerator. You put your clothes in a closet.

Where do you put your most valuable items — like jewelry, rare stamps & coins, and important papers?

Those items belong in a safe deposit box or a bank lockbox.

What Is A Lockbox?

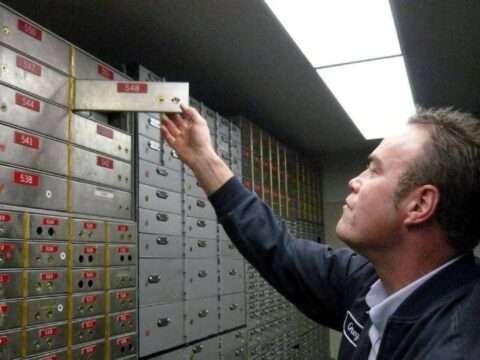

A lockbox (or safety deposit box) is a miniature safe-like box located inside a bank.

These boxes are sealed in a vault for the ultimate safety and protection of your items.

Here are 5 pros and 5 cons to storing your valuables in a lockbox or bank safe deposit box…

Reasons To Use A Safe Deposit Box

Here are the top 5 reasons to use a safety deposit box:

- Your items are protected from fire, flood, or other natural disasters at home.

A natural disaster can destroy much more than the house itself. It can destroy memories — like photographs, jewelry, birth certificates, and other important records.

You should keep your most valued possessions, copies of your important papers, and even your photographs in a safety deposit box away from your house.

- It’s a cost-effective way to keep valuables private and safe.

Only you know what’s inside your lockbox — not the bank, not your relatives, not anyone that you don’t personally tell yourself.

You’re probably wondering, “How much does a safety deposit box cost? And what are the safe deposit box sizes you can choose from?”

The cost for a safety deposit box varies, depending on size and what region of the country you are in:

- The smallest box is 3″x5″ and typically rents between $15 and $25 a year.

- A medium box measures 4″x10″ and the annual rental fee usually falls between $40 and $65.

- The largest box offered is 15″x22″ and the rent is typically between $185 and $500 a year.

NOTE: Safety deposit boxes are usually 18- or 24-inches long (or deep… depending on how you look at it).

- Your items are protected from theft at home.

- Your valuables can’t be stolen from your home if they’re not there. A safety deposit box gives you that extra peace of mind, just in case your home is ever burglarized.

- While home safes can be bought for as little as $99, they’re much easier for thieves to crack.

- Most home safes weight less than 100 lbs, so it’s not that difficult for thieves to walk off with your safe (and your valuables).

There are several reasons you should opt for a bank safe over a home safe:

Bank safes — where safety deposit boxes are kept — are securely constructed and heavily guarded.

- Your items are protected from being lost or misplaced.

If you’re the type to misplace papers and other items, then you might benefit from using a lockbox instead of trying to keep valuables and important papers organized at home.

At banks, the industry standard is to keep a written inventory of the items in the box. And sometimes photos of the items as well.

Your safe deposit box is kept locked under dual control — which means 2 things are required to open it:

- A key from the bank – bank employees have special keys that are unique to each safe deposit box.

- Your key – The renter of the safe deposit box receives 1 or 2 keys that are also unique to their box.

Your box remains securely locked at all times in the bank’s safe.

- Your family members will know where to find your important papers & valuable items.

As long as you keep a copy of important papers (like your will or insurance forms) in a safety deposit box, then your family members will be able to retrieve those items — if you cannot for one reason or another.

If you rent the box only in your name… then you, a power-of-attorney, or an agent that you designate are the only ones who can get into the locked box.

A safe deposit box rented jointly with a spouse, child, or friend means those people also have access.

Experts say it’s wise to have a designated power of attorney to handle your financial affairs (including access to your box) in case you’re unable to because you are disabled or traveling, among other reasons. As long as you have a power of attorney, then getting into your safe-deposit box won’t be a problem.

Of course, safety deposit boxes are not without their issues…

Downsides Of Safe Deposit Boxes

Here are the top 5 reasons NOT to use a safety deposit box:

- A safe deposit box can only hold so many items.

Safety deposit box sizes start at 3”x5” and are as big as 15”x22” — so there are definitely size limitations as to what you can put inside a bank lockbox. You’re mostly limited to jewelry, papers, and other small items.

TIP: You can rent 2 small boxes for about the same cost as one large box.

- You must keep track of the key.

Each box has a double lock that requires 2 keys to open. One is the bank’s key. The other is the customer’s key. Each key is useless without the other! And no one can open (or lock) your box without your key.

So… if you’re someone who often loses or misplaces keys, then you will need to take extra-special care to not lose your safe deposit box key! Banks cannot let you into your safety deposit box without a key. If you do lose the key, you will have to pay the bank for special locksmith services to get another key made — and replacement key charges can be very high.

Be sure to make a copy of your safety deposit box key and keep both keys apart from each other and in safe places (not with your house keys or car keys). Don’t keep the lockbox keys on a keyring or in an envelope with the bank’s name or the location of your safe deposit box. Give your extra key only to someone you trust.

In addition to the dual-key security feature, there is also an authorized signature card that prohibits anyone not on that card from accessing the bank lockbox.

When the safe deposit account is initially opened, all persons authorized to access the box sign the signature card. The bank can only allow those individuals to enter the box. From then on, the bank records the signature of any individual allowed to enter the box.

~ Comptroller of Currency

- You don’t have 24/7 access to your safety deposit box.

Safe deposit boxes are located inside banks — which have limited hours.

Also, if the owner of the safe deposit box becomes deceased, then the box may be sealed for weeks with important documents inside of it. (To open a sealed bank lockbox, estate representatives are required to provide court papers to the bank.)

It’s best to store the original documents in a safe in your house, and use the safety deposit box as a place to keep back-up copies of those documents.

When a bank becomes insolvent or goes bankrupt, the Federal Deposit Insurance Corporation shuts down the bank’s operations and seizes control of its assets. The contents of a safe deposit box are not at risk in any way during the closure of a bankrupt bank. However, you may have limited access to the contents of your box for a period of time.

~ Pocket Sense

- Items can still get damaged in a safe deposit box.

Safety deposit boxes are “resistant” to fire, flood, heat, earthquakes, hurricanes, explosions, and other disastrous conditions. However, there is no guarantee that your items won’t get damaged if the building gets destroyed.

In fact, floods and plumbing catastrophes are far more common than bank heists these days.

TIP: For added protection, it’s a good idea to put your valuables inside a waterproof bag or container before putting them inside your safe deposit box. Put your name on each item and take photos of all items. That way, if a disaster occurs your chances of successfully recovering an item would be much greater. Also, try to rent a box that is located higher in the room (rather than lower).

- Items can still be stolen from a safety deposit box.

Safe deposit boxes do get robbed, but it’s incredibly rare. Thanks to alarms, cameras, motion detectors, and heat detectors, the items inside of a bank lockbox are much safer there than inside your home.

Still, if items are stolen, you may not be able to recoup the loss. So it’s wise to add a homeowners or renters insurance rider to cover the items kept inside your safety deposit box.

The FDIC only insures deposits in deposit accounts at insured institutions and only in the rare instances when a bank fails. A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen.

~ Federal Deposit Insurance Corporation

Items To Keep In A Safe Deposit Box

Following are the most important things you SHOULD keep in a safe deposit box:

- Insurance policies

- Pictures or videos of your home’s contents for insurance purposes

- Property deeds

- Titles to cars, boats, and other vehicles

- Detailed list of bank and brokerage accounts, CDs, and credit cards

- Marriage license / Divorce decree

- Birth certificates / Adoption certificates

- Death certificates

- Social Security cards

- Custody agreements

- Expensive, rarely-worn jewelry

- Stock and bond certificates

- Contracts / Legal papers

- Military service records / Military discharge papers

- Hard drives & flash drives with backups of important data

- Family heirlooms

- Collectibles like coin collections & stamp collections

- Irreplaceable photos and memorabilia

- Sensitive documents you wouldn’t want roommates, children, or relatives to stumble across.

- Copy of your health information (vaccinations, hospitalizations)

- Copy of your will (see the exception to the rule below)

Whether your will should be at the bank or elsewhere (such as with your attorney) depends on what your state law says about who has access to your safe deposit box when you die. Ideally, the person you name to oversee your financial matters after you die (your “executor” or “personal representative”) should have early access to your original will (copies are not valid). Some states make it relatively easy for co-renters, family members, or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person’s safe deposit box. In those states, it may be a good idea to leave your will in the safe deposit box. But other states may require a court order or another official action to remove the will — which can take time and money. That is why you should check with a bank official (or your lawyer) to find out what is required under state law and your bank’s own policies in the event of your death.

~ Find Law

Items That Don’t Belong In A Safe Deposit Box

So, what should NOT be stored in a safety deposit box?

Anything that you might need to access quickly! This includes:

- Cash that’s not in a deposit account (like a savings account or certificate of deposit) isn’t protected by FDIC insurance.

- Passports that you might need for a last-minute trip

- “Power of attorney” contracts that authorize others to transact business or make decisions about medical care on your behalf

Do not put inside a safe deposit box anything you might need in an emergency — in case your bank is closed for the night, the weekend, or a holiday. Possible examples: originals of a “power of attorney” (your written authorization for another person to transact business on your behalf), passports (in case of an emergency trip), medical-care directives if you become ill and incapacitated, and funeral or burial instructions you make. Consider giving the originals to your attorney, and making copies to go in your safe deposit box or to give a close friend or relative.

~ Twin River Bank

The Bottom Line

In the end, I really do recommend that you use a safe deposit box for your valuables and important papers.

The main takeaways here are:

- Take extra care with the key.

- Waterproof each of the items first.

- Only store copies of your papers inside the safety deposit box.

When deciding what you should put inside your safe deposit box, ask yourself the following question for every single item you’re considering putting inside: “If this item was lost, would I be in big trouble?” If your answer is yes, then that item goes inside.

If you’re still reluctant to put items in a bank lockbox because of privacy concerns…

Just know that such fears are unfounded — liability laws keep banks from prying into safe deposit boxes and viewing the contents.

Dig Deeper

Want to explore more about bank lockboxes?

Here are a few additional resources that have helpful info about safe deposit boxes:

Like this post? Save it to read again later… or share with others on Pinterest!